Starting the new year with a new financial mindset is a good resolution. If you’re one of the few who believe that changing your habits changes your life, stay with us.

We are going to teach you how to manage money—the hardest task of all. Ironically, once you really understand the root of your money problems, financial stability will become a second nature to you.

Most of us dream of achieving financial freedom, and we hate to break it to you but there’s no rulebook for it. However, after spending years in the lending industry, we have gained insights on habits that bring you close to your financial goals.

We’re finally going to let the secret out! In this article, we have listed a step-by-step guide that will help you take charge of your financial health.

Check Where You Currently Are At (Financially)

Before achieving your financial goals, it is first important to understand where you stand. This may look like taking an honest peek into these 3 things:

- What is your current income (after tax deduction)?

- What are your monthly expenses (without overspending or over budgeting)?

- How much are you comfortably saving each month?

Try to be objective about your money issues, any lingering debt you have, and how you’re managing your finances in the now. This is a crucial step in learning how to manage money.

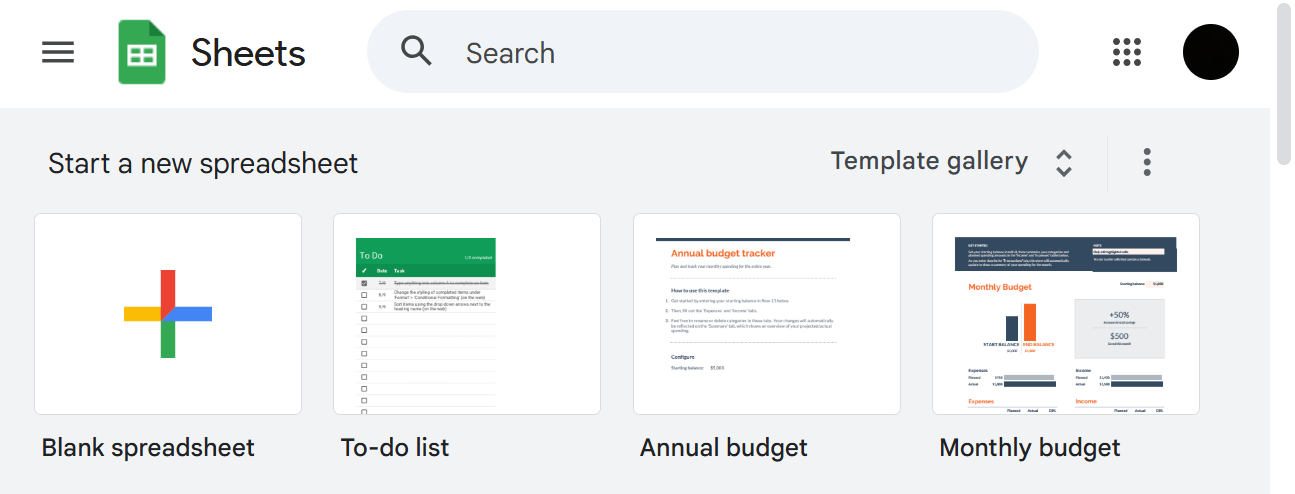

You may try using Google Sheets or Excel to cleanly lay down how much you’re earning, spending, and saving every month. For example, you earn $3,500 monthly, spend $2,500, and save $500.

What if I have overspent?

It might be possible that looking at the figures feels bad. But understand that you’re only human, and it is not possible to always spend ideally.

At times, overspending happens and that is okay. Our goal here is to actually put pen to paper and practically notice areas where saving money could be possible.

Looking forward, you may want to plan a goal to work around. You will not always save what you plan but surely more than when you don’t plan at all.

Keep an Eye on Your Debt

Take a review of all your existing debt as well—credit cards, student loans, personal loans, cash advances, etc. Because part of smart financial planning means making room for repayments in your monthly budget.

In the short term, you may feel like you’re saving no money, but eventually you’ll become financially free. There are ways you can pay off your debt while also saving to build an emergency fund.

Start Setting Clear Financial Goals for 2025

You can start by dividing your financial goals into two categories—short term and long term. To put it in context, saving for an emergency fund, paying off small debts, and budgeting on the daily will come under short-term financial planning.

Whereas, planning to buy a home, saving for retirement, and wishing to be financialy free someday falls under long-term financial planning. All the actions you take today to reach a point, where your investments and savings are completely covering your expenses, come under this planning.

You might be seeing that for both, the short-term and for the longer run, you need to take steps in that direction starting in the present itself. With money, time and conscious decisions mean everything.

SMART Goals Framework

When you’re sat down planning your finances, the key is to follow the SMART Goals structure.

S – Specific

M – Measurable

A – Achievable

R – Relevant

T – Time Bound

The more specific your goals are, the easier it will become to achieve them. There will be all sorts of distractions or temptations to drag you off your course, but as long as you stay consistent and determined, managing money will feel easy.

Your financial health matters because it lifts the stress that comes with worrying about money constantly. The quality of your life and relationships will improve as a result!

If you’re struggling to manage debt or expenses, you may turn to online payday loans for helping out with emergency expenses for some time. However, be mindful of borrowing only what you need and not using these loans for everyday expenses.

Create a Realistic Budget

More often than not, why people struggle to stick to their budget is because of their unrealistic expectations. There has to be some space for spending on things that are absolutely necessary.

50/30/20 Rule

The most effective way to budget is to set aside 50 percent of your monthly income for needs (rent, utility bills, groceries), 30 percent for wants (movies, dining out, shopping), and 20 percent for savings or debt repayment.

You may also want to use free budgeting tools like Mint, You Need a Budget (YNAB), or even Google Sheets. There are in-built templates in Sheets that help you keep a track of your monthly as well as annual budgets.

Clearly outline your reasons for planning the budget and that will motivate you to stick to it. Because let’s be honest, who doesn’t like an extra pair of boots? Even if you’ve got debt to pay off, always make sure to set aside a portion for savings. This will help you stay on track during financial emergencies as well.

If you need money unbearably, you can get same-day payday loans online. They offer you quicker access to cash at low interest rates. You can later pay back in monthly installments. (Note: Don’t borrow if your Debt-to-Income Ratio is higher than 45 percent).

Build an Emergency Fund

There is a general rule of thumb about how much money you should have saved. The amount varies from person to person, but your emergency funds should help you sustain 3-6 months of living expenses. You can save this money in a separate account to avoid touching it.

How to save money fast?

The quickest way to save money today is by eliminating useless subscriptions, including Netflix! Apart from that most of us also end up spending excessively on dining out. Cutting down on these costs by preparing your meals at home, shopping groceries in bulk, and turning to healthy forms of entertainment like taking a walk or spending time with family will help.

Improve Your Credit Score

When you have a higher credit score, you qualify for better loan terms (lower interest rates) and higher credit limits. People who have attained financial freedom value this because good credit scores give them the ability to take out money, invest it in a business, and ultimately make more money.

For seeing improvements in your credit score, pay back before the due dates and reduce your credit card balance. Keep checking for any errors in your credit report from time to time. Some people believe that checking your credit score lowers it, but that is not true.

Start Saving and Investing for the Future

The way to becoming financially free goes through investing in stocks, bonds, mutual funds, etc. even smaller amounts can compound over time. Avoid investing for the short-term and expecting quick returns. Instead, let the money sit in diverse tools for a longer period of time.

Starting early puts you at an advantage because even $200 invested every month for 20 years at an interest rate of 7% gives a return of $100,000.

Track & Adjust Your Financial Plan

The last step to managing your money is knowing when to revise the plan. If you’re in a situation better than a year ago, saving just 20 percent of your monthly income wouldn’t make any sense. Keep adjusting based on situations (e.g. promotion, having a baby).

To Wrap It Up

Experimenting with different budgeting techniques will help you find the unique ways of managing money that work for you. It is okay to fail at times as long as you stay consistent to your goals.

Also, check out our 1-hour payday loans online with no credit checks. They can help you get a sense of security in place of emergency funds while you’re on to it.

Hey I am so excited I found your blog, I really found you by accident, while I was searching on Yahoo for something else, Anyhow I am here now and would just like to say thanks a lot for a fantastic post and a all round thrilling blog (I also love the theme/design), I don’t have time to go through it all at the minute but I have bookmarked it and also added in your RSS feeds, so when I have time I will be back to read a lot more, Please do keep up the fantastic job.