Payday Loans in Florida: Receive the Funds You Need Quickly & Safely

Are you facing an emergency and needing extra cash to cover the expenses? It may be for home improvements, car repairs, medical bills, rent, wedding expenses, debt consolidation, credit card debt, or other unexpected costs. Online payday loans in Florida help you borrow small amounts to cover these extra charges until your next payday.

You can apply for your loan online, get approved within minutes, and receive funds within just an hour. While most lenders expect you to repay in a lump-sum short after you borrow the loan, our installment loans have the room for longer repayment periods and allow you to pay back in monthly payments!

How Payday Loans Work in Florida

You can usually borrow payday loans in Florida through lenders online or in-store. The application process is fairly smooth when you’re doing it online.

Here’s what taking out Florida payday loans online with us would look like:

Application

We know you need a loan when you’ve submitted a request through our online loan application. Our website is encrypted with 256-Bit Data Encryption, a powerful security system that safeguards your personal information from intruders. All you need to share is an email address where we can contact you, the loan amount you need, and the purpose of your loan.

Approval

Once you have submitted your request, our lenders review your application which is usually approved within minutes. There are no credit checks, so you don’t need to worry about being approved because of a bad credit score. Our lenders look at other things like your income, debt-to-income ratio, etc.

Fund Disbursement

We understand that during an emergency, the last thing you need is weeks of approval time and lengthy documentation. Your funds are disbursed as soon as your application is approved or often on the same day.

Payday Loans Florida: Laws & Regulations

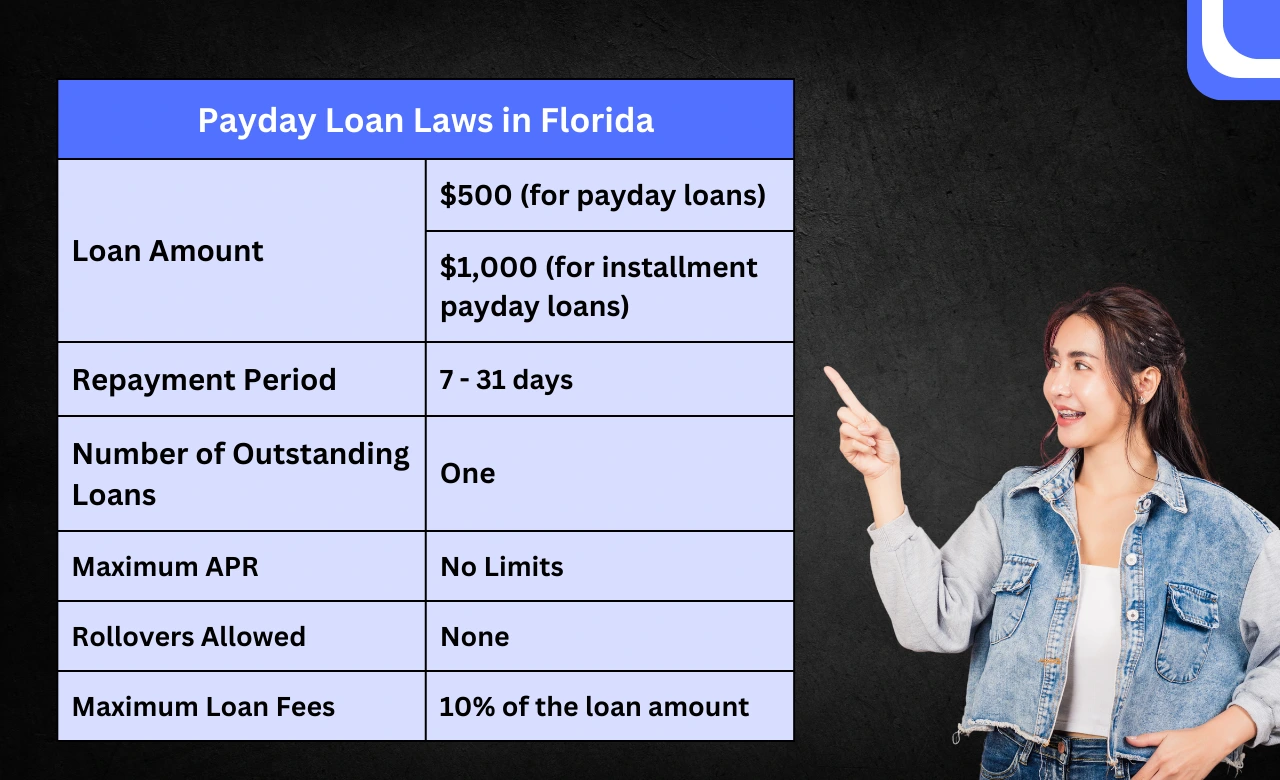

The state-specific restrictions limit the payday loan rates in Florida. This is done to protect you from predatory lenders who try to charge usurial APR (Annual Percentage Rate), keeping you stuck in a cycle of debt.

Anyone who offers you loans crossing these limits is lending illegally:

There are no APR limits for payday loans in Florida. However, we still cap our APRs at 35.99 percent. If your profile is good, you can secure interest rates as low as 5.99 percent.

The lenders we connect you with also offer longer repayment periods (61 days to 72 months) and a monthly installment payment structure so you can pay back comfortably. It is thus convenient to choose our Florida loans up to $500.

What if I fail to repay my loan?

In the rare event that you’re unable to repay your payday loan in Florida, there are other state laws that protect you:

- Lenders cannot put criminal charges on you

- You have a 60-day grace period to repay without additional charges

Why Choose My Payday Loans Online?

Our services are recognised as one of the best online payday loans for Florida, because of:

- We Connect You to Reputed Lenders Online

- Easy Application Process

- Minimal Documentation

- No Credit Score Checks

- No Collateral Requirement

- Fast Approvals and Access to Funds

- Repayment in Manageable Monthly Installments

- Longer Reapayment Periods

- Lowest Interest Rates

- 24/7 Assistance & Application Submission Online

Eligibility Criteria for Payday Loans in Florida

To qualify for our online payday loans in Florida with no credit checks, here’s what you’ll need:

- You must be 18 or older

- An active bank account

- Government-issued ID

- Income proof

- Residencial proof

- Social Security Number

Tips for Responsible Borrowing

While taking out our Florida payday loans online is probably the safest, there are still some best measures at your end that will help you borrow responsibly:

- Borrow only what you need.

- Don’t borrow for everyday expenses (food, rent)

- Repay early to avoid extra interest or cost of borrowing

- Never take multiple loans at once

- Check if the monthly installments fit in your monthly budget

- Never sign documents before reading every detail

- Don’t take payday loan if you have other options to borrow money

Alternatives to Payday Loans in Florida

If you’re unsure about taking payday loans, you can explore our Title Loans as well. This can be done when you need higher loan amounts or when you’re okay with putting up collateral to borrow money.

Here are some other ways to borrow money:

- Ask your friends or family to lend you

- Get a secured loan from banks or credit unions

- Freelance to earn some extra cash

When you’ve run out of these options, our online payday loans in Florida are always here to help!

Frequently Asked Questions

Can I apply with bad credit?

Yes! Our lenders welcome those with a bad credit score to explore our payday loans in Florida.

How fast can I receive funds?

Once you have applied, your application gets approved within minutes, and the funds are disbursed within an hour or on the same day.

Are payday loans safe?

Payday loans are safe until you use them smartly. If you’re missing payments or rolling over your loans, it can cause debt spirals. Furthermore, Florida’s payday loan laws protect you from predatory lenders so as long as you’re borrowing responsibly, these loans won’t do any harm.

Installment Loans near me